How to buy /login PNB MetLife online Term plan

How to buy /login PNB MetLife online Term plan-Pnb Metlife

What is PNB MetLife online Term Plan ?

PNB MetLife online Term Plan is a pure protection plan with a range of additional coverage options to protect financial future of loved ones. The policies in this plan have been designed to address the policyholder’s protection requirements at an affordable cost.Term plan gives your family’s safety and security that is importance to you and for everyone. Term plan or Term insurance is also called pure life insurance product that provides coverage for a certain period of time or a specified “term” of years. If the insured dies during the time period specified in the policy and the policy is active or in force, then the death benefit will be paid. The premium paid on term life insurance is used to cover the risk of insuring the policyholder. This allows the policyholder to opt for higher sum assured at affordable premiums. Term insurance is the best way to financially secure your family’s future in case of any untoward scenario. It covers the policyholder for a long period of time at very low cost. Generally, the policy term starts from the age at which the policy is purchased. It ends when the policyholder reaches the age mentioned in the policy. Thus, it is possible to get a term insurance policy for 50 or even 60 years at the affordable premium which may vary during the premium paying term and it covers the customer till 99 yrs of age. PNB MetLife online Term insurance also comes with riders which provides additional coverage asides the term insurance benefit. These riders cover additional benefits such as accidental death, disability, critical illness diagnosis, terminal illness diagnosis, waiver of premium and provide extra benefits that are paid out when the conditions are met. Term insurance allows the policyholder to opt for a high sum assured. This policy provides the best way to financially secure your family’s future.In a term plan, policy benefits are given to the nominees chosen by the life assured in case of an insured event.

Getting an online term plan is extremely simple in these digital times. Most insurance companies have their plans set up online which makes it easy to check. But why We should buy term insurance online?

Low premium

Insurance agents or other insurance intermediary make it convenient to buy an insurance policy. However, the insurance company has to pay a commission to the agents to provide a service which ultimately translates into a higher premium. While buying an insurance policy online, there is no need for an agent which saves the company premium. This reflects in cheaper premiums.

Easy to Buy

Buying a term insurance policy online is extremely convenient. It can be done from your home at your convenience. All you need to do search on google PNB MetLife online term plan , pick out the term plan and choose any riders and add-ons and pay the company. You can buy a policy online in a matter of a few clicks.

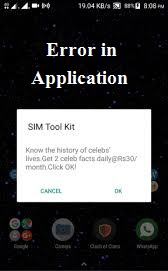

How to buy or login PNB MetLife online term plan

For login online PNB MetLife term plan you to follow these steps :

2..After Click on Term Plan : Best Term Plan in India - PNB MetLife option ,Now you can see on image Buying option is available there .Click on that .After Click Online option will show you tap on it ...

3.After Click on online option pop up window will show you .please select an options available there After this Click on get quote .

4.Next You can see Protection cover and Policy Term options are there ,you can choose the cover from 25 lakh to Crores according to customer Annual Income .Also you have flexibility to choose their Terms to till 99 years .After choose these options you can move for further .Now you have to click on bottom at the amount showing in yellow color for proceed further.

5.Feel your all details on this pop up window and click o submit .

5.Feel your all details on this pop up window and click o submit .

6.Now you can see Four options are there Lump Sum payout ,Lump Sum + Regular Monthly Income ,LumSum + Increasing Monthly Income , LumSum + Regular Monthly Income till the chilled 21 yrs you can choose the best option which you like .

7.Go for further click on Premium option at bottom on your screen. Also you have options for Choose additional riders Accidental Risk cover ,Accidental disability rider, Heart and cancer ,serious illness rider.

7.Go for further click on Premium option at bottom on your screen. Also you have options for Choose additional riders Accidental Risk cover ,Accidental disability rider, Heart and cancer ,serious illness rider.

8.Click on premium payment option for next page ,your Application number will be generated After this Go to next page .Now you can see payment option will show you .

Comments

Post a Comment